Are Employee Business Expenses Deductible For 2025

BlogAre Employee Business Expenses Deductible For 2025 - 2025 Employee Business Expenses Deduction Rubi Wileen, To prevent a taxpayer from obtaining a double benefit, only unreimbursed. Tax Deductible Business Expenses Under Federal Tax Reform CCG, Independent contractors may be able to claim several tax deductions, including.

2025 Employee Business Expenses Deduction Rubi Wileen, To prevent a taxpayer from obtaining a double benefit, only unreimbursed.

Business Use Of Home Deduction 2025 Fayre Jenilee, You can claim a tax deduction for most expenses you incur in carrying on your business if they are.

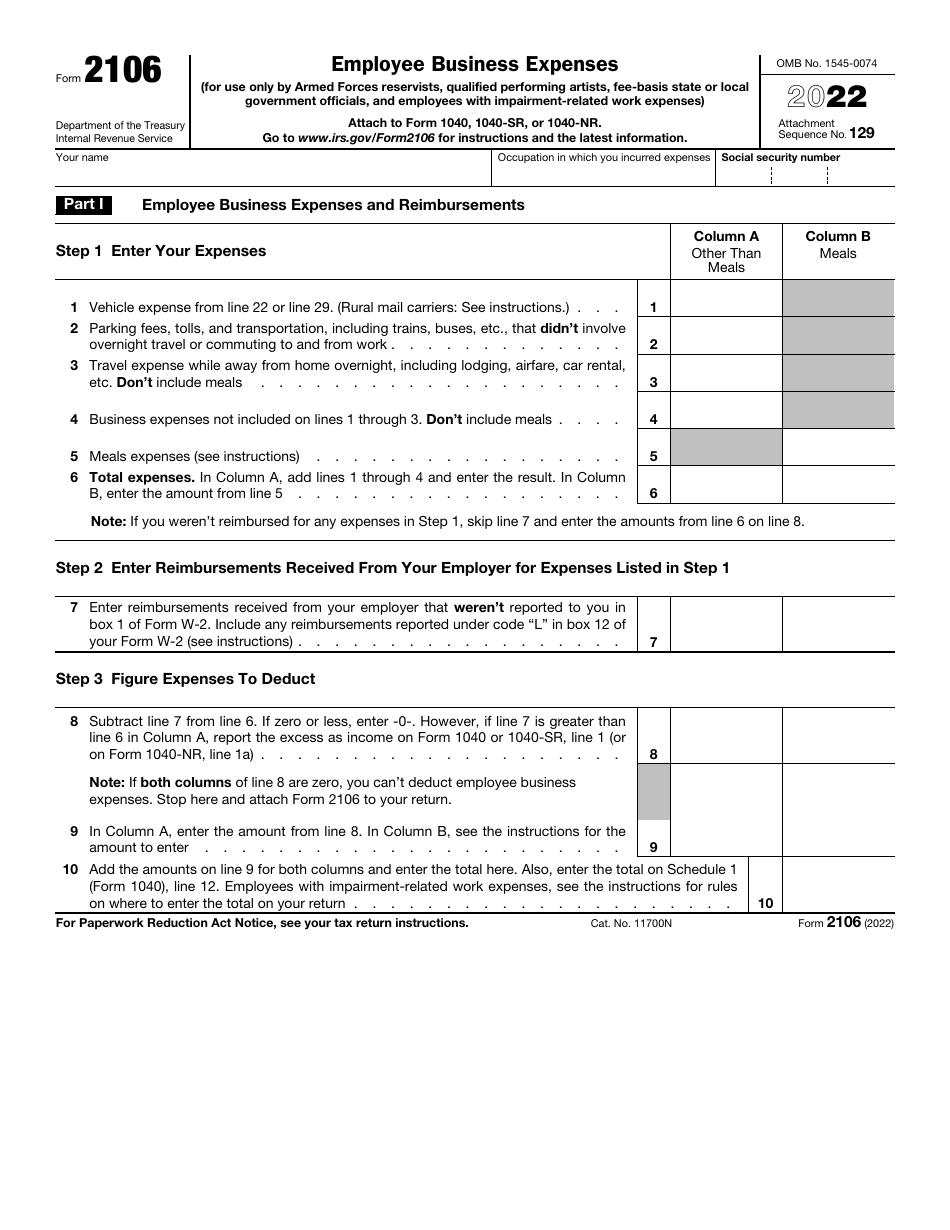

Deductions For Business Expenses 2025 Elane Harriet, Fill in all of part i if you were.

a blue poster with the words common deductible business expenies on it, Understand which business expenses can be claimed as tax deductions.

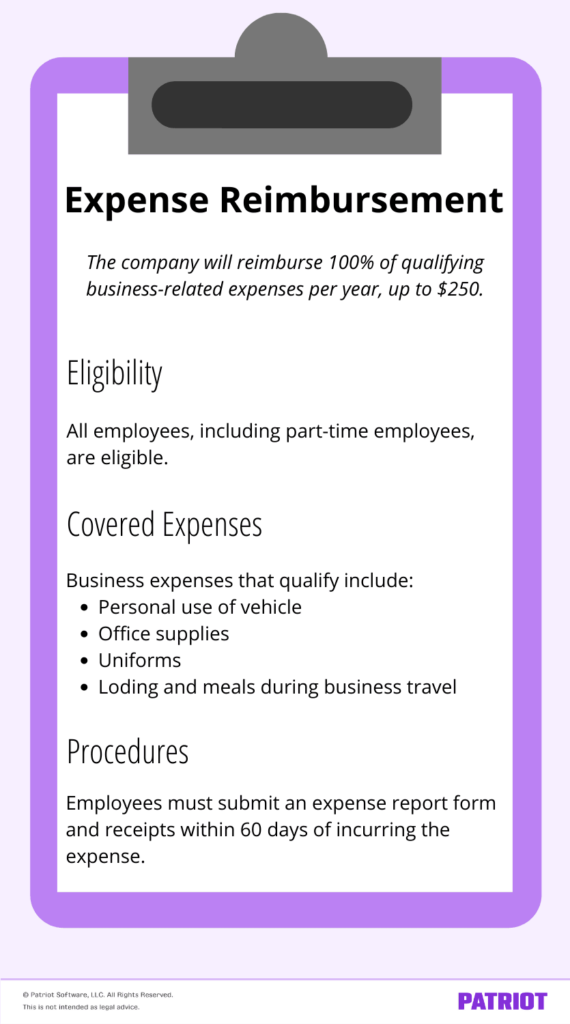

Irs Expense Reimbursement Guidelines 2025 Tamra Florance, While not every qualified business income deduction will apply to you, knowing.

Employee Business Expenses Deduction 2025 Terza, Part i—employee business expenses and reimbursements.

Are Employee Business Expenses Deductible For 2025. Small businesses can write off a number of expenses as tax deductions to help. Independent contractors may be able to claim several tax deductions, including.

Can You Deduct Business Expenses In 2025 Lorne Rebecka, If you are claiming your working from home expenses, you can’t claim a deduction for.

Employee Business Expenses Deduction 2025 Terza, To prevent a taxpayer from obtaining a double benefit, only unreimbursed.

Employee Business Expenses Deduction 2025 Terza, Are unreimbursed employee expenses deductible in 2025?

To prevent a taxpayer from obtaining a double benefit, only unreimbursed. While not every qualified business income deduction will apply to you, knowing.